Key Insights

- Agentic AI goes beyond automating work. It automates expertise so that agents collect information, take decisions, adapt to changing information and improve over time, just like humans.

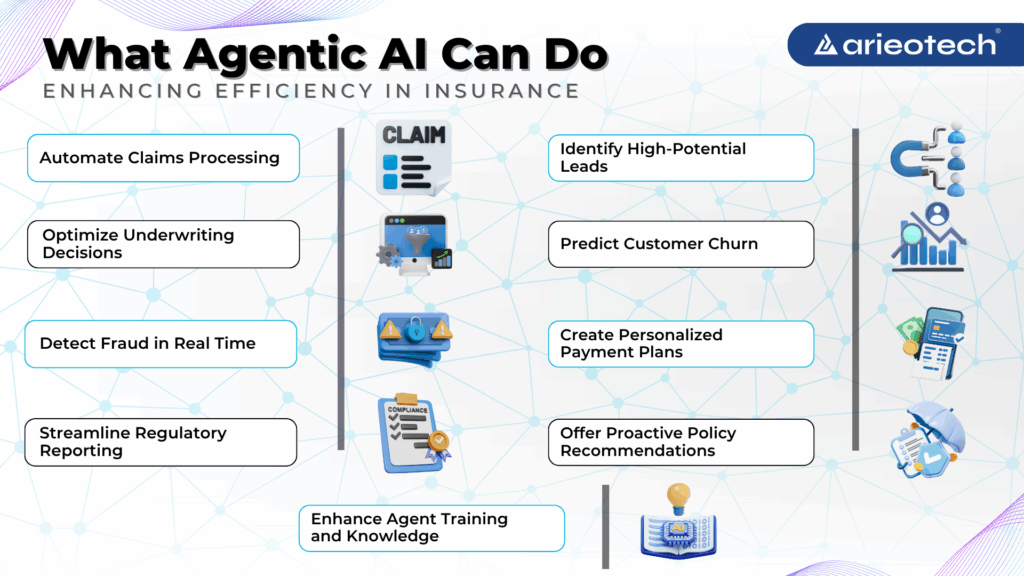

- In insurance, Agentic AI can introduce next-level efficiency by taking care of the preliminary and tedious manual work while freeing up human agents to refine and calibrate outcomes for the high customer satisfaction

- The specific tasks Agentic AI can streamline within insurance include claims automation and management, fraud detection and prevention, personalized policy design and planning

- For optimized use of Agentic AI in insurance, a strategic plan with clearly laid-out goals, review of technological- and service-provider options, incorporation of a skilled team with regular training, frequent monitoring and adaptation of systems while staying ever-vigilant about regulatory and ethical compliance is key

Why Agentic AI is a gamechanger for Insurance

Stepping up as a key driver of change, Agentic AI is transforming insurance. That’s because agentic AI is not just automating work, it’s automating expertise. Going a step beyond rules-based systems, AI agents make decisions, take actions, and learn from results. For the insurance industry, this offers fresh ways to process claims, spot fraud, and interact with customers.

This means insurers can now move faster and deliver more accurate outcomes for clients. As more carriers adopt agentic AI, the industry is moving toward smarter, more responsive service for everyone involved. But what exactly is Agentic AI? Let’s find out.

What is Agentic AI and How Does It Work?

Agentic AI is driven by goals, not tasks. Here’s how that becomes possible.

Agentic AI is essentially a development and step forward in the automation eco-system. And Agentic AI is setting itself apart from standard automation. Think of it as software that doesn’t just follow set rules; instead, it makes its own choices, adapts to changing information, and gets better at its job over time. Almost like humans. For insurance providers, this means a shift from reactive systems to proactive agents capable of handling real customer needs, evaluating claims, and spotting fraud with less manual effort. Let’s understand these advancements in detail in the next section.

Defining Agentic AI

What Agentic AI is

Agentic AI is a form of artificial intelligence that acts independently to reach assigned goals. Unlike older AI that needed constant instruction, agentic systems use autonomy and reasoning to decide what to do next.

AI vs Agentic AI

Understanding the advancements and what sets Agentic AI apart from traditional AI

| Aspect | Traditional AI | Agentic AI |

| Definition | AI systems designed to perform specific tasks with set inputs | AI systems capable of autonomous goal-setting and decision-making |

| Autonomy | Low: follows programmed rules or trained behaviors | High: operates independently, adapts goals and methods |

| Goal Orientation | Task-driven (e.g., classification, prediction) | Goal-driven, often pursuing broader, self-defined objectives (Fraud detection) |

| Adaptability | Limited to training data or predefined updates | Learns from real-time feedback and adapts strategies dynamically |

| Planning & Strategy | Executes predefined steps or fixed models | Plans, strategizes, and revises approach as needed |

| Tool Use | Uses built-in or hardcoded tools | Can choose, use, and even create tools to achieve goals |

| Memory and Learning | Often stateless or session-based learning | Maintains long-term memory and continuous learning |

| Ethical Concerns | Limited, mostly around bias and misuse | Higher, includes autonomy, safety, unintended goal pursuit |

| Examples | Spam filters, image classifiers, language models like ChatGPT | AutoGPT, BabyAGI, open-ended agents with tool use |

Agentic AI differs from AI on the following counts:

So what does this mean? It means that while generative AI creates things like text or images, agentic AI takes action—executing steps much like a human agent would, but faster and at scale. Check out this overview of agentic AI for a business-focused summary.

How Does Agentic AI Actually Work?

A breakdown of the steps involved in achieving this breakthrough

To understand how agentic AI operates, look at this simplified breakdown of its workflow:

- Perceive

The AI takes in information—claim details, customer queries, policy data, or alerts.

- Reason

It analyzes the input. Using large language models and other advanced algorithms, it maps out possible actions.

- Act

The system makes decisions and carries out steps—initiating claim reviews, flagging suspicious patterns, or sending custom messages.

- Learn

After taking action, it reviews feedback or results. If it spots a fraudulent claim, for example, it notes what features made it stand out. If a claim process was delayed, it looks for ways to cut time next round.

This cycle allows the AI to handle complex, multi-step tasks with little human oversight. Agentic AI in insurance, for instance, might read policy documentation, compare it to new claim data, consult fraud databases, and then either approve a claim or escalate for review—all on its own. For a deeper look at the technology’s reasoning abilities, this detailed explanation from Nvidia provides valuable insights: What Is Agentic AI?. While this explains what makes Agentic AI transformative, what are the unique promises it holds for the insurance industry? This is covered in the next section.

What Makes Agentic AI Different for Insurance?

Specific use-cases and benefits

The kind of autonomy offered by agentic AI means:

- Fewer manual handoffs and bottlenecks

- Faster claim settlements

- More accurate fraud spotting due to real-time analysis

- Ability to resolve customer questions directly, even after hours

Here’s an insurance-focused example:

- A customer submits a claim for a damaged vehicle

- The AI quickly reviews the policy, matches photos for consistency, and cross-references known fraud patterns.

- If all checks out, the system approves the payout—or it flags the claim for extra review if red flags pop up.

The best thing about such systems is that they don’t just follow the case in hand. They adapt as cases change, and each action makes them a bit smarter for next time. This ongoing self-improvement helps insurers operate with speed and precision, meeting new customer expectations head-on.

For more on the key differences between types of AI in business, see this in-depth agentic AI discussion.

Use Cases of Agentic AI in Insurance

Given its scalability and efficiency potential, Agentic AI promises an overhaul in the way insurance companies operate today. Across the industry, innovative insurers are adopting autonomous systems to speed up claims, lower fraud, and offer better, more personalized coverage. Here’s how agentic AI is delivering results in real-world insurance workflows.

1. Claims Automation and Decision Support

Agentic AI has revolutionized the claims process by taking on time-consuming manual tasks and making real-time decisions that used to sit in human queues for days.

These systems can:

- Collect and review claim documents, accident photos, and policy details within minutes.

- Automatically match claim information with policy coverage, eligibility rules, and prior claims.

- Provide claim adjusters with instant suggestions—flagging items that meet approval standards or highlighting outliers for review.

- Recommend next actions, such as payout or escalation, based on evidence and historical data.

Insurers have seen claim processing times shrink from weeks to hours, with workloads shifting from paperwork to meaningful decision review. For more on how agentic AI is driving these results, explore this overview on agentic AI in insurance claims resolution.

2. Fraud Detection and Prevention

Fraud threatens insurance profits and fairness. Agentic AI uses adaptive algorithms to spot patterns even the best experts might miss.

Compared to traditional rules-based software, agentic AI:

- Analyzes large volumes of claims data across regions and time periods.

- Detects emerging fraud tactics by comparing new claims to known suspicious behavior.

- Flags risky cases instantly for deeper investigation—before payouts go out the door.

- Continuously learns and updates its own fraud models to stay ahead of new threats.

This advanced detection closes the window for opportunistic fraud and allows teams to focus on legitimate claims. A recent post on agentic AI for fraud prevention explains how these tools can identify even the most sophisticated scams.

Personalized Policy Design and Pricing

Agentic AI makes it possible to provide minutely personalized service. It lets insurers treat each customer as an individual who feels heard, seen and valued.

With advanced data analysis in insurance, agentic AI:

- Reviews personal and behavioral data, like information about lifestyle, to better assess risk.

- Suggests customized coverage options for unique needs—no more one-size-fits-all policies.

- Calculates premiums based on real-world behavior instead of broad demographic averages.

- Adapts offers over time as customers’ lives change, using ongoing feedback and engagement.

This approach leads to fairer prices and happier customers, as coverage matches actual needs more closely. Learn how agentic AI is raising the bar for personalization in this summary on agentic AI transforming risk and customer relationships. Now that some of the benefits of Agentic AI for Insurance are clear, let’s dive into what makes its adoption essential business strategy.

Key benefits of agentic AI in insurance

Why you should leverage agentic AI services

Agentic AI offers numerous benefits for the insurance industry, enhancing efficiency, accuracy, and customer satisfaction. Here are some key advantages:

1. Scalability and Efficiency

- Speed: Agentic AI can process vast amounts of data quickly, reducing the time required for tasks such as claims processing and fraud detection.

- Cost Reduction: By automating routine tasks, insurers can lower operational costs and allocate resources more effectively.

- 24/7 Operation: AI systems can operate continuously without breaks, ensuring that processes like claims handling and customer support are always active.

2. Improved Accuracy and Fraud Prevention

- Enhanced Detection: AI algorithms can identify complex fraud patterns that might be missed by human analysts, reducing the incidence of fraudulent claims.

- Real-Time Analysis: Continuous learning and real-time data analysis help AI systems stay ahead of emerging fraud tactics, providing a proactive approach to fraud prevention.

- Personalized Customer Experience

- Tailored Policies: By analyzing individual customer data, AI can offer personalized policy recommendations and pricing, leading to more accurate risk assessments and fairer premiums.

- Customer Engagement: AI-driven insights allow insurers to engage with customers more effectively, offering relevant products and services based on their unique needs and behaviors.

3. Strategic Decision-Making

- Data-Driven Insights: AI provides insurers with valuable insights derived from large datasets, enabling more informed decision-making and strategic planning.

- Predictive Analytics: By leveraging predictive analytics, insurers can anticipate trends and adjust their strategies accordingly, staying competitive in a dynamic market.

In summary, agentic AI is transforming the insurance industry by enhancing operational efficiency, improving accuracy, and delivering personalized customer experiences. As these technologies continue to evolve, their impact on the industry is expected to grow, driving further innovation and improvement.

Adoption strategy for agentic AI in insurance

Step-by-Step Implementation Guide

Implementing agentic AI in the insurance industry requires a strategic approach to ensure successful integration and maximized benefits. Here are key steps for adopting agentic AI:

1. Assess Needs and Objectives

- Identify Pain Points: Determine the specific areas where automation can add value by bringing time- and cost-efficiency.

- Set Clear Goals: Define measurable objectives, such as reducing claim processing times, improving fraud detection rates, or enhancing customer satisfaction.

2. Choose the Right Technology

- Evaluate Solutions: Research and compare different AI technologies and vendors to find the best fit for your needs.

- Pilot Programs: Start with pilot projects to test the technology in a controlled environment and gather insights before full-scale implementation.

3. Build a Skilled Team

- Hire Experts: Recruit AI specialists, data scientists, and IT professionals with experience in implementing AI solutions.

- Train Staff: Provide training for existing employees to ensure they understand how to work with AI systems and leverage their capabilities.

4. Integrate with Existing Systems

- Ensure Compatibility: Make sure the AI solution can seamlessly integrate with your current IT infrastructure and software.

- Data Management: Establish robust data management practices to ensure high-quality data is available for AI analysis.

5. Monitor and Optimize

- Continuous Improvement: Regularly monitor the performance of AI systems and make adjustments as needed to improve accuracy and efficiency.

- Feedback Loop: Collect feedback from users and stakeholders to identify areas for improvement and ensure the AI solution meets their needs.

6. Address Ethical and Regulatory Considerations

- Compliance: Ensure that AI implementations comply with relevant regulations and industry standards.

- Ethical Use: Develop guidelines for the ethical use of AI, including transparency, fairness, and accountability.

By following these steps, insurance companies can effectively adopt agentic AI, driving innovation and achieving significant improvements in their operations and customer service.

Agentic AI is quietly reshaping key insurance tasks, making every process more accurate, fast, and customer-centered. The current applications lay the groundwork for bigger changes on the horizon.

Frequently Asked Questions

1. What is Agentic AI and how is it used in the insurance industry?

Agentic AI refers to autonomous systems that can perform tasks and make decisions without human intervention. In the insurance industry, it is used for automating claims processing, detecting fraud, personalizing policy design, and improving customer service.

2. What are the benefits of adopting Agentic AI in the insurance industry?

The benefits include increased scalability and efficiency, improved accuracy in claims processing and fraud detection, personalized customer experiences, and data-driven strategic decision-making. These advantages help insurers reduce costs, enhance customer satisfaction, and stay competitive.

3. What are the challenges in adopting Agentic AI in insurance?

Challenges include integrating AI with existing systems, managing data quality, ensuring regulatory compliance, addressing ethical concerns, and training staff to work with AI technologies. Overcoming these challenges requires careful planning and ongoing support.

4. How does Agentic AI impact customer satisfaction in insurance?

Agentic AI enhances customer satisfaction by providing personalized policy recommendations, fairer pricing, and faster claims processing. It allows insurers to engage with customers more effectively and offer services that meet their unique needs and preferences.

5. What is the best way of implementing Agentic AI in insurance?

The adoption strategy involves assessing needs and objectives, choosing the right technology, collaborating with expert partners such as arieotech, integrating AI with existing systems, monitoring and optimizing performance, and addressing ethical and regulatory considerations.