In today’s market, speedy delivery of services is paramount. The insurance sector is no exception to this maxim of time as money and must adopt AI to speed up its underwriting processes. That’s because demonstrating efficiency and optimization has a direct bearing on customer experience. With rising customer expectations, insurers are under pressure to deliver faster quotes, manage risk more effectively, and do it all while keeping costs under control. Artificial intelligence (AI), particularly generative AI, is emerging as one of the most powerful tools to meet these demands.

In this blog post, we break down some specific insurance tasks AI simplifies—and the very real business impact of that transformation.

The unwieldy risk of manual underwriting

But first, let’s pause to consider the mountain of tedium that is underwriting. For years, underwriters have operated in an environment of data overload. Their workdays often involved manually sifting through dense documents like loss runs, Schedule of Values (SOVs), and Market Reform Contracts (MRCs). They spent hours copy-pasting data between spreadsheets, quoting systems, and static PDFs. Then, they had

to spend additional time making sense of disparate formats.

Beyond the paperwork, asset valuation posed an even greater challenge. Whether pricing a commercial property or evaluating a fleet of vehicles, underwriters traditionally relied on static databases, spreadsheets, and human judgment to assess risk. This meant delays and inconsistencies.

The insurance promise of AI underwriting

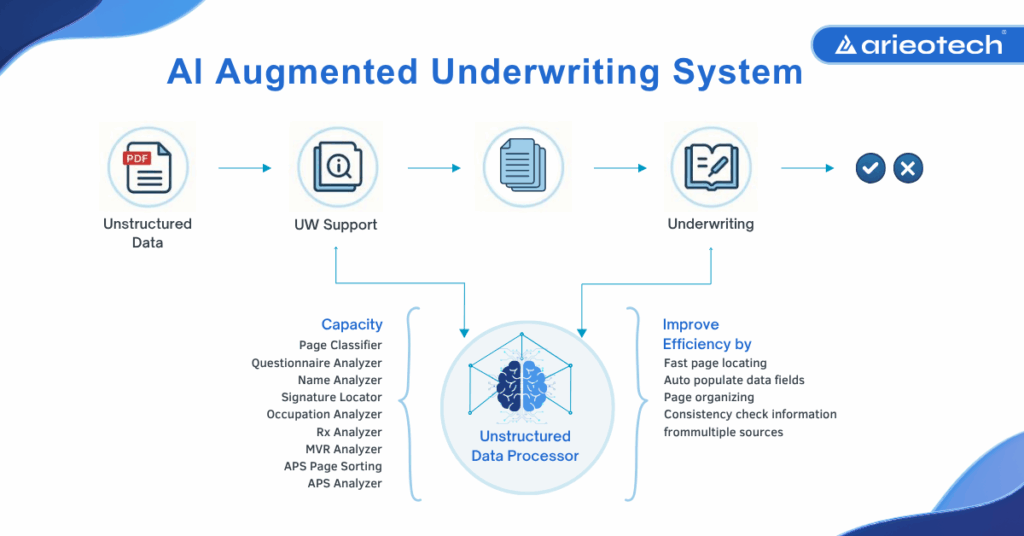

Enter Gen AI. The advent of large language models (LLMs) and natural language processing (NLP) has redefined underwriting by making it fast, efficient, and highly accurate. AI systems read and summarize lengthy policy documents, extract relevant details from unstructured data, and generate critical insights: all in a matter of minutes. With their predictive modeling, these technologies also help flag anomalies or missing information.

AI is beginning to break longstanding bottlenecks in underwriting—not with brute force, but with precision and speed. Two areas in particular are seeing transformative gains: document ingestion and risk assessment.

A real-world use case: Supporting the underwriter, not replacing them

To understand this shift in action, imagine a neighborhood pizza shop looking to renew its insurance policy. On the surface, it’s a small, straightforward task. But for the underwriter, it involves multiple layers of due diligence.

They must begin by reviewing the shop’s financial history, credit score, and any past claims. Then, they assess whether the current policy still reflects the business’s needs. Has the shop added new ovens? Started offering delivery? Renovated the premises? Each change could significantly alter the risk landscape. Next comes scanning the market for alternatives that might offer better terms or more relevant coverage. Finally, the underwriter recommends the best fit: protecting both the business and the insurer.

Now, add AI to this process. AI tools can instantly pull the shop’s credit and claims history, auto-summarize the existing policy, and compare dozens of coverage options. Recommendation engines can flag policies better suited to the shop’s growth, all based on real-time data.

This isn’t about replacing the underwriter. It’s about giving them the time and space to focus on what really matters: exercising judgment, having meaningful conversations with clients, and making informed decisions in complex cases.

How AI Simplifies underwriting in practice

1. Smarter Document Ingestion

AI can automate document ingestion to extract critical data across complex documents such as loss runs, SOVs, and MRCs. By combining optical character recognition (OCR), NLP and LLMs, key data is summarized and standardized across several formats such as PDFs, spreadsheets, and docx files to name a few. This data can then be used seamlessly in quoting platforms and downstream analytics. The result is substantial: up to 40% reduction in manual data entry and a notable acceleration in quote generation speed, freeing underwriters to focus on more strategic tasks.

2. Automated, Dynamic Risk Assessment

By ingesting geospatial information, historical loss trends, and financial records, AI systems can build detailed, real-time risk profiles. These models identify patterns that may go unnoticed by traditional tools, helping insurers achieve more accurate and consistent underwriting decisions. The benefits are twofold: improved pricing accuracy and a reduction in operational overhead.

By taking over the repetitive, time-consuming parts of the job, AI frees underwriters to do what they do best: make informed decisions, handle complex or ambiguous cases, and build strong relationships with brokers and clients. When leveraged this way, AI can empower teams to deliver better results every time and catalyze strategic business growth.

What are you waiting for? Get the AI + human advantage for yourself today. Get in touch with arieotech and power your operations with AI now.